What Is the Infinite Banking Concept?

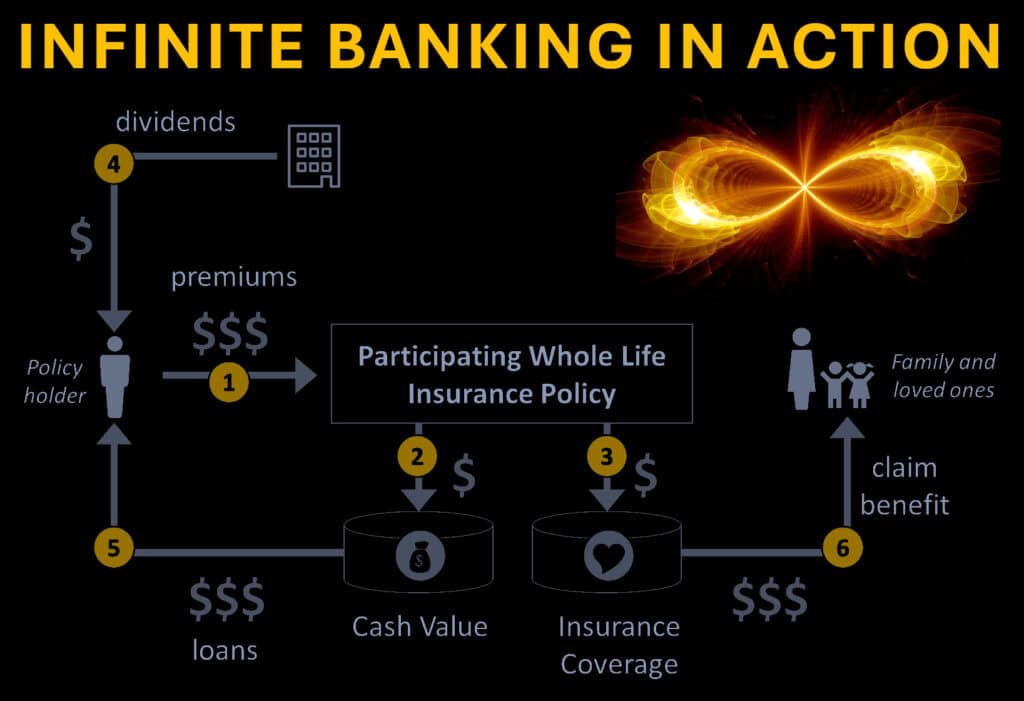

The infinite banking concept, popularized by Nelson Nash, involves using a whole life insurance policy as your own personal bank. It's a cash flow management system where you borrow against the policy's cash value to finance purchases, then repay yourself with interest. This allows you to earn interest on both the borrowed money and the policy's cash value, essentially becoming your own banker.

The Infinite Banking Concept is an exercise in imagination, reason, logic, and prophecy. — Nelson Nash, Becoming Your Own Banker, a book by Nelson Nash.

Why do we deposit money in banks? We do so to safely save money, which we can access later to pay bills and make purchases.

Here's a simplified breakdown:

- Traditional Banking: Instead of borrowing from traditional banks for major purchases, you use the cash value of a whole life insurance policy.

- Borrowing Against the Policy: You can borrow against the policy's cash value without needing to go through a bank.

- Repaying Yourself: You then repay the loan to yourself, essentially recycling the money and earning interest on the policy's cash value.

- Potential Benefits: According to proponents, this system can potentially save on interest fees, allow for more readily accessible funds, and build wealth over time.

- Considerations: According to the Corporate Finance Institute, this concept requires discipline and a consistent repayment schedule. However, it is not without potential drawbacks, such as the risk of not being able to meet loan obligations or the initial cost of the whole-life policy.

FIND OUT MORE ->

If you use a participating whole life insurance policy for Infinite Banking, your cash value increases every time the insurance company pays dividends. It also increases when you pay policy premiums and earn a guaranteed interest rate.

Related Services Links

- Your Life - Debt-FREE Life

- Your Life - Infinite Banking

- Your Life - A Plan for Business

- Your Goals - Enhance your wealth

- Your Goals - Protect Your Family ▪️ Mortgage Protection

- Your Goals - Financial Independence - Save Enough to Meet Your Needs

- Your Future - Ensuring Your Retirement Security

- Your Future - Ensure the Long-term Care We Need

- Your Future - Final Expense Life Insurance

Disclaimer: This content was generated using AI and Human Verification.

Article Author:

Cheri Lucking, CEO of Lucking Life Insurance, and Peter Lucking, Co-author/Web design, CEO of Content Branding Solutions

“Advocate. Business Owner. Protector of Women-Owned Wealth. Helping Women-Owned Businesses Protect, Grow, and Pass on their Legacy. Let’s make sure everything you’ve built doesn’t end with you.” – Cheri Lucking

Cheri Lucking Bio:

She is a published author and has held various roles in advertising, marketing, communications, sales, distribution, and product branding and development. Cheri lives with her husband, Peter, and their dog, Coco. Cheri enjoys cooking, gardening, hiking, and wine, although not always simultaneously. She loves music and is an avid reader,

She would tell you, "I cannot live without books." Cheri agrees but would add cheese, the Food Channel, and nature to that list.